Transcendent and Ontier's Impact Observatory invite Sir Ronald Cohen, the father of impact investing, to Madrid to present his book "Impact" in Spanish.

On 4 October 2023, the first edition of the event "Spain, leading country of impact: Transforming capitalism for change".. An event organised by the Impact Observatory by Transcendent and Ontier which was attended by Sir Ronald CohenHe is considered the father of the impact economy, founder of the venture capital firm Apax Partners and chairman of the Global Steering Group for Impact Investment (GSG), the world's leading initiative to drive impact investment.

A committed philanthropist, venture capitalist, private equity investor, great social innovator, as well as a leading pioneer in driving the Impact Revolution worldwide, he spoke about the keys and the opportunity for Spanish companies to have a clear sustainability strategy, to embrace impact and technology to find new markets and lines of business that generate high economic benefit while having a positive impact on people, as stated in his latest book, "The Impact Revolution". book presented at this event in Madrid in its Spanish version "Impact: Transforming capitalism for change"..

Before more than 300 leaders from the public and private sectors, entrepreneurs and the third sectorof the vice-president of the CEOEIñigo Fernández de Mesa, the director-general of CaixaBank AM and Chairman of SpainNABJuan Bernal, the vice-president of the Impact Observatory and president of OntierPedro Rodero, and the president of the Impact Observatory and partner of TranscendentThe Impact Revolution is guiding consumers, entrepreneurs, investors, businesses, companies, philanthropists and governments to create tangible and measurable impact. To completely transform our economic model, the risk-return-impact trinomial must become the epicentre of our decision-making.

Putting impact at the heart of business strategy requires a process of transformation to a new level, where the impact of business companies incorporate the impact they generate into their strategic decisions.The impact they have on their stakeholders can be measured and managed.

As Cohen explained, "when we look at the world through a lens of impact, we discover opportunities for greater growth and profitability that would otherwise have gone unnoticed. In short, doing good can be big business".

"The Impact Revolution is guiding consumers, entrepreneurs, investors, businesses, philanthropists and governments to create tangible and measurable impact". In fact, today cn increasing number of companies that, by managing sustainability as a strategic element of managementhave on their roadmap evolve its business model towards impact. "We must transform our economic model so that instead of causing problems, we generate solutions," Cohen said.

Generating more value for money from impact

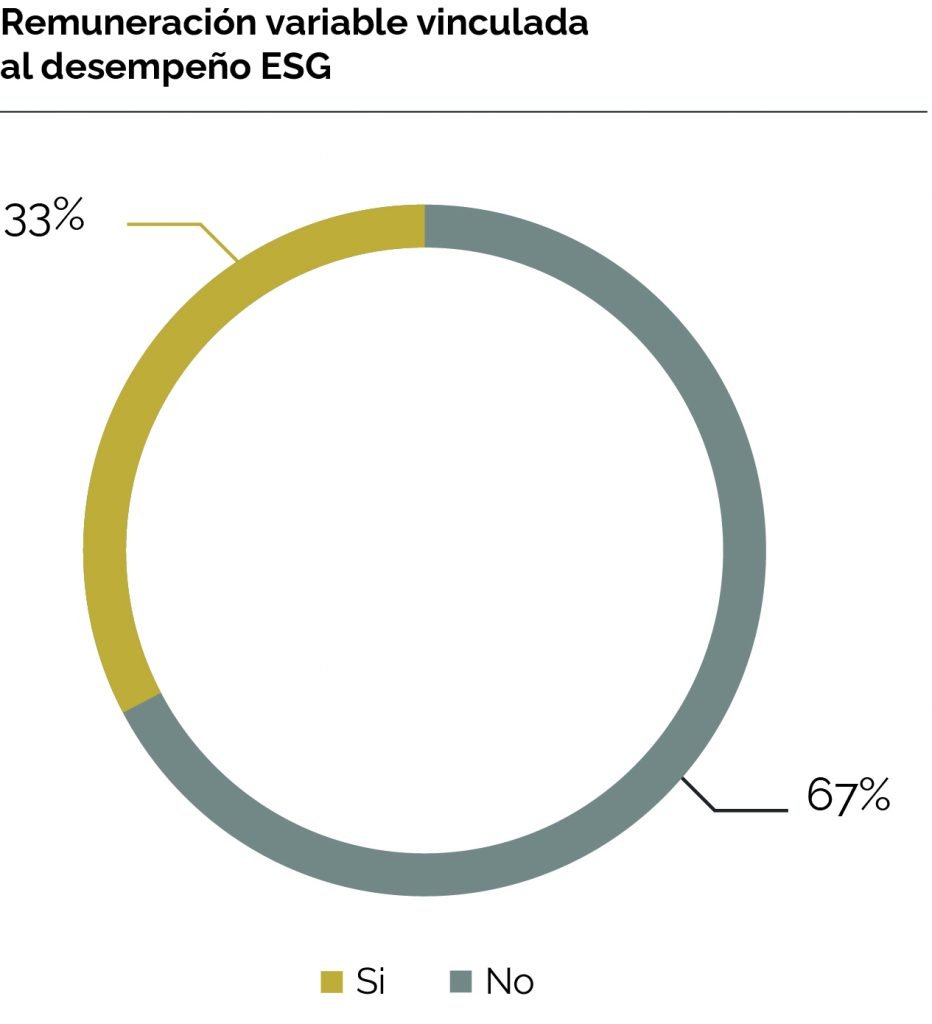

This change in model is reflected in greater recognition of companies that meet ESG criteria, drive long-term value creation and prioritise economic activities that optimise positive social and environmental impact, rather than purely short-term financial return.

As a result, the volume of impact investment has grown exponentially, mobilising over the last few years 1 billion in impact investment and 40 billion in ESG investment.

Today's capitalism, based solely on economic profit, can be changed to a capitalism that is focused on economic profit and social impact alike, redirecting large flows of capital to improve the world, explains the author and renowned entrepreneur.

"It is time for us to raise our voices, to make an impact through our decisions. From how we work, buy and invest, to how we influence our governments," said Sir Ronald Cohen.

This meeting, the second organised by the Impact Observatory this year, aims to promote the impact that companies are capable of generating based on an economic model centred on not only in minimising harm, but also in generating a positive impact.

The event closes a key year for Spain, following its start with the Impact Week in mid-June in Madrid, and as the venue for the GSG Annual Congress in Malaga in early October.