The report "Managing ESG issues in listed companies". The Transcendent study, which analyses 85 companies listed on the continuous market, including all IBEX35 companies, found that only 13% has measurable social commitments.

The urgency to incorporate Environmental, Social and Governance (ESG) issues is setting the agenda of the main corporate governance bodies and has become part of their strategic priorities.

The business transformation towards sustainability implies a change of mentality, a real challenge from an organisational and operational point of view. Its transversality requires aligning all areas of the company.

To find out about the degree of progress in this transformation in leading Spanish companiesIn addition, we have decided to carry out a report, which focuses mainly on three aspects:

- Developments in the structure of sustainability governance.

- How the commitment to environmental and social issues translates into concrete and measurable objectives.

- Linking the achievement of these sustainability objectives with the remuneration of managers.

Following our analysis, we have found that the speed at which companies are advancing is not the same, and the difference between IBEX 35 companies and the rest of the listed companies is very palpable.

We have also identified that companies have a strong focus on environmental factors, while social aspects are much less present and, when they are, they focus mainly on gender issues and the pay gap.

Materiality as a focal point for prioritisation

Beyond its commitment to the environment and society in general, a key element that influences the sustainability strategy and should drive the strategy when setting targets is materiality. These sustainability priorities will vary significantly depending on the sector, the company's strategy and also the expectations of its stakeholders.

In defining both strategy and objectives, companies can decide to reduce its impact negative and/or generate benefits for their stakeholders. They can also plan their contribution to solving existing social and environmental problems. Those objectives aimed at benefiting stakeholders or contributing to solutions are the ones that will have the greatest impact and competitive advantage for the company and, therefore, are where the company should focus.

Although, due to regulation and tacticality, companies are now focusing on setting environmental targets, it should not be forgotten that the following should not be forgotten social aspects which will undoubtedly involve the next big milestone in sustainability In some sectors, it has become a truly differentiating factor.

The great difficulty in setting social objectives lies in their measurement, which must be based on international standards, many of them still under development, such as the EU's Social Taxonomy.

Dashboards for sound decision making

For proper decision-making, directors and executive directors should be able to rely on tools that allow them to monitor and "operationalise" sustainability. within the company, providing a balance between strategic and tactical vision. A key tool is a dashboard that defines the objectives set by the company's management and makes it possible to determine the degree to which these objectives are being achieved.

Due to its nature transversal and to its marked strategic nature, sustainability requires a governance structure that supports decision-making and is accountable for its management. This is why it is the establishment of multidisciplinary governing bodies is necessary.This implies, at a strategic level, ensuring the company's ESG purpose and performance and, at a more operational level, facilitating coordination to achieve common objectives.

However, the level of reporting, the functions and the dedication (exclusive or not) of such governance bodies will largely depend on the size of the company, the sector in which it operates and what its relevant sustainability issues are.

ESG Remuneration and sustainability integration in the company

Another key element is the integrating sustainability into the company's culture. To this end, it will be important to equip both the board and the other employees with the knowledge and skills needed to capacities necessary for its implementation, which will entail the organisation of activities of training y internal communication.

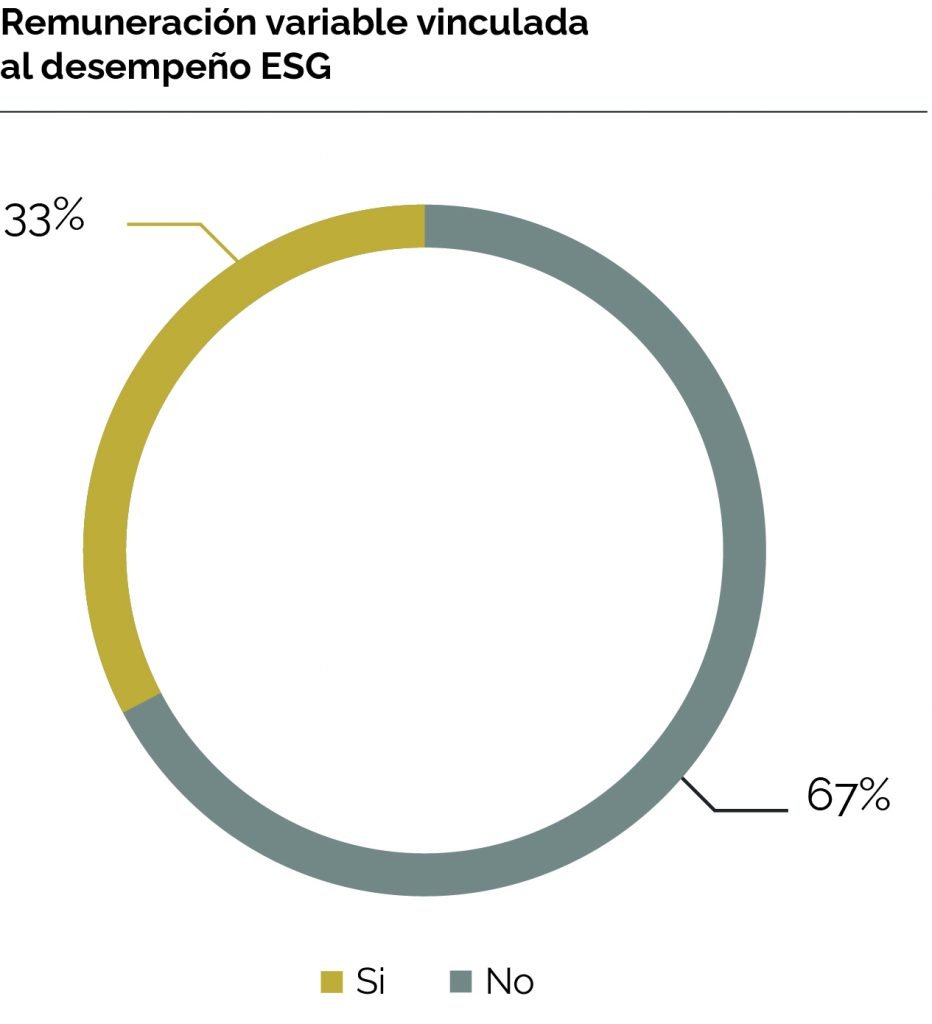

Last but not least, there is the ESG performance-related remuneration that is a strategic lever which encourages the involvement of employees in decision-making and their active participation in the achievement of common goals.

According to the report, in IBEX companies, 54% of companies already have variable remuneration linked to ESG aspects. However, of the non-IBEX companies analysed, only 181 PT3T have incorporated specific remuneration packages linked to ESG performance.

Top management remuneration packages linked to social and environmental objectives will accelerate their implementation as part of companies' remuneration policy, both in the short and long term because there is a trend among all stakeholders (consumers, companies, employees, investors, regulators and public institutions) to measure and value the impact of companies.

Main findings of the report

- In terms of sustainability, although all companies demonstrate their commitment to people and the planet, only 40% of the analysed companies communicate concrete and measurable environmental objectives.. This percentage drops to 13% for social objectives.

- In terms of ESG performance-related pay, there has been notable progress in the companies in the IBEX y 54% of companies already have variable remuneration linked to ESG aspects.

- The 68% of IBEX 35 companies have a Sustainability Committee (either specific or shared with other functions), which reports directly to the Board of Directors, while in 2018 this figure was three times lower (20%). This evolution over the last 2 years is largely due to the growing demand from investors and increased regulation in these areas, including the reform of the CNMV's Corporate Governance Code.

Ultimately, companies that do not incorporate the sustainability at the heart of its activity are going to compete at a disadvantage with those that do. Declarations of intent and commitments are of little use if there are no strategic plans with clear objectives and monitoring indicators to back them up.

The new business paradigm requires courageous and bold leadership that knows how to manage this challenge as an immense opportunity, challenging existing models and evolving their businesses from sustainability to impact generation.