If we look back five years, we see clear progress in many social and environmental aspects. But if we look at the objectives set at a global level, there is no doubt that we must accelerate the pace if we want to reverse the effects we are experiencing due to the climate crisis. The year 2024 will be key and business will play a fundamental role in this process of accelerating and consolidating sustainability as a lever for social and environmental improvement. Below, we list the main trends in sustainability and impact that we at Transcendent expect for the year 2024:

1. The beginning of the end of Greenwashing

The European Parliament's approval of the Green Claims Directivewhich is scheduled to take place in the first quarter of 2024, will be a key milestone in the fight against the practice of Greenwashing. A regulation that will also be reinforced by the Regulation on Ecodesign of Sustainable Productswhich aims to be approved by the Commission during the same period of 2024, incorporating eco-design requirements for European products in order to improve their environmental sustainability. Within this regulation, it also envisages the establishment of a new "Digital Product PassportThe aim is to help consumers and businesses make informed decisions when purchasing products.

2. Sustainability as a new critical skill

The growing commitment of companies to sustainability has triggered a revolution in the labour market. We are witnessing a significant boom in demand for professionals specialising in sustainability areas. According to the International Labour Organisation (ILO), 24 million new "green jobs" will be created by 2030.

In 2024, we will see how they consolidate positions such as ESG Controller in financial departmentsThis is practically non-existent today. The The sector's employability is set to continue to rise. The average recruitment rate with at least one "green" skill is 29% higher than the average for the labour market..

New recruitment of young people will not meet demand of the nearly 4,000 corporations that have committed to achieving net zero emissions by 2030. In fact, by 2024, it is expected that more than 70% of the vacant posts in sustainability are filled by external transfers and cannot be filled by internal promotions, due to lack of training..

As a result of this upturn in demand for jobs in this sector, there will be an increase in the number of jobs in this sector. increased demand for specialised academic training in sustainability.

3. No more 2050 targets: from grandiloquence to concreteness

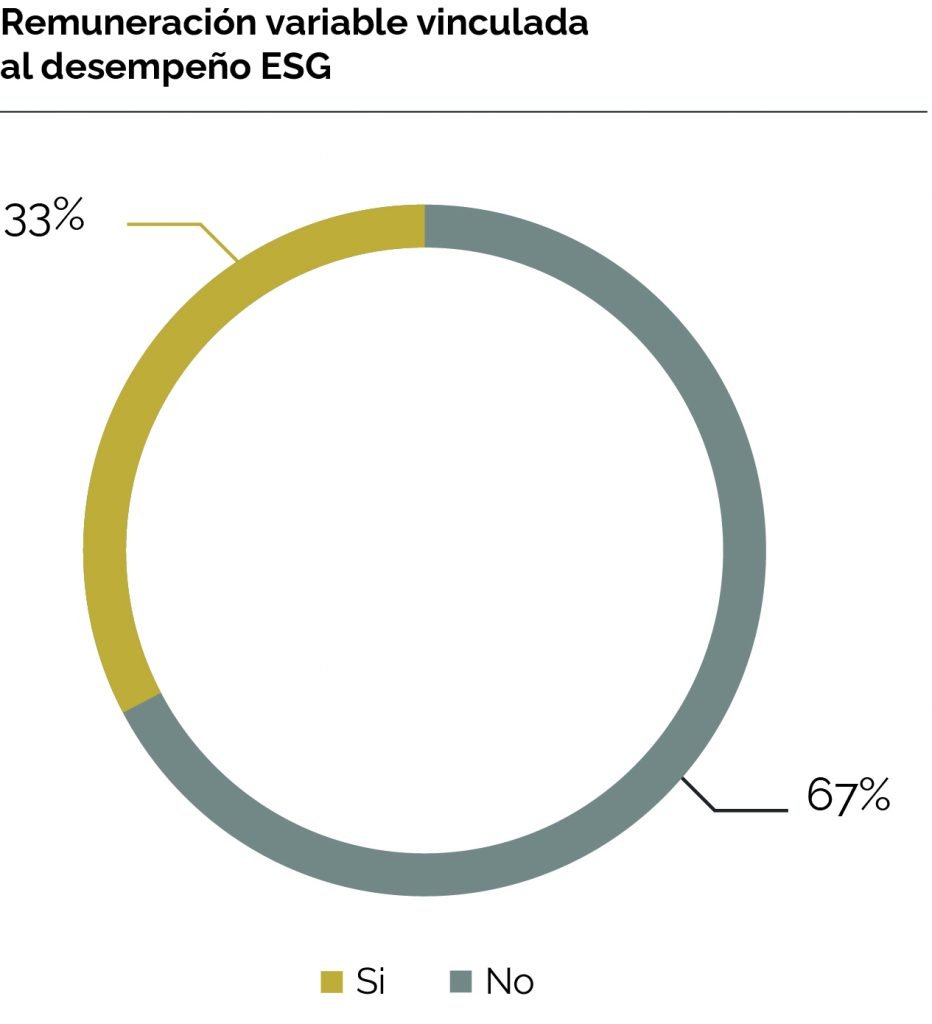

Pressure from investors, ratings and regulation will cause targets beyond 2030 to lose value this year.. In the coming months, companies will have to account for their social and environmental targets to shareholders, investors, employees and the market itself. Therefore, they will have to be accountable to shareholders, investors, employees and the market itself, ratings and ESG rankings no longer value medium- and long-term objectives The balance between sustainability objectives and the need to generate shareholder value will begin to shape companies' sustainability strategies.

4. Large business as a catalyst for sustainability

Large companies will lead the change. More than 50,000 European companies will be obliged to include their analysis of the double materiality in its business strategies from this year onwards and in a progressive manner.. In Spain, the draft CSRD is still subject to possible modifications, but it will undoubtedly change the way Spanish companies manage their ESG objectives. Sustainability reporting will be placed on the same level as financial reporting and there will be no turning back.

The European Union is working on the Corporate Sustainability Due Diligence Directive (CSDDD)for which approval is expected from 2025. This directive establish an obligation to identify and prevent, terminate or mitigate actual and potential impacts on human rights and the environment.e. A key aspect of this directive is that it will require companies to apply due diligence not only to their own operations, but also to the activities of their subsidiaries and other entities in their value chain with which they do business, seeking a global impact.

5. The take-off of impact investment in Spain

Impact investing in Spain is expected to take off in 2024. The volume of assets under management by the supply of impact capital in Spain in 2022 has increased by 21% compared to 2021 and is expected to will continue to increase in 2024, fuelled by the creation of financial solutions that allow businesses to access cheaper finance in exchange for more impact.

Although the figures for these assets, which seek to obtain a financial return as well as a positive impact on the environment and society, have not yet been made public, various private equity funds and foundations expect their assets under management to grow by more than 50%. Along the same lines, the Spanish government has created the Social Impact Fund (FIS), with resources of 400 million euros and managed by Cofides, to invest in companies and projects that strengthen entrepreneurship and the social economy in Spain. In this way, public money can act as a catalyst to attract private investment.

Impact investment that next year will be marked by the financing of transformative projects associated with the energy transition and social impact projects (vulnerable populations, identified risks).

6. Integrating sustainability and impact into business strategy

The integration of sustainability and business impact will be key in 2024 for companies that want to lead the change. Until now, materiality analyses have been projects without much use. With the CSRD and the obligation to conduct dual materiality analyses, risks and opportunities emerge. The European Commission's new report on the materiality of the double materiality analysis will be presented to CFOs, risk managers, as well as when carrying out strategic and business plan exercises. More than 50,000 European companies will be obliged to include their dual materiality analysis in their business strategies from this year onwards on a progressive basis.

In Spain, the draft of the CSRD is still subject to changes, which will be one of the essential aspects of a regulation that will take place this year and which will put the sustainability reporting at the same level as financial reporting in the decision-making process of the various stakeholders.

7. Measuring to monetise impact, for businesses that want to go further

At the corporate level in Spain, we will see how some companies, in order to differentiate themselves and seek to generate a net positive impact, will begin to incorporate impact measurement and management into their strategies and reporting..

The number of companies publishing sustainability and impact net income statements is set to multiply in the coming months.

This process is still incipient, as only 14% of IBEX 35 companies and 2% of the continuous market have incorporated impact measurement models, according to Transcendent's report "Evolution of ESG management towards impact in listed companies".

The consolidation of standardised methodologies that allow companies to measure, value and monetise the impact of companies on the environment and society will favour the measurement of the impact and monetisation of the actions carried out by companies.

For all these reasons, 2024 is a key year for sustainability and impact in our country. The management of social and environmental aspects will continue to be a priority for companies, but the way it is managed will go beyond that. The evolution, maturity and sophistication of this sector will require companies to adapt ever faster if they want to lead the change. Other media such as Expansion o Ethic have also talked about these new sustainability trends and impact for 2024.