Businesses are key players in today's society. Many of the world's great advances have come from the private sector. Michael Porter, in his study on shared value, shows many examples of how business has driven social development.

The first large-scale programme to diagnose and treat HIV was set up by an Anglo-American company to protect its workers in South Africa, according to a new report. Mark R. Kramer y Marc W. Pfitzer in its article The shared value ecosystem published in the Harvard Business Review. MasterCard is another great example, having successfully implemented mobile banking, providing access to financial services to 200 million people worldwide. And the most recent case is the COVID vaccine, which has been developed and distributed thanks, in large part, to the efforts of the pharmaceutical industry.

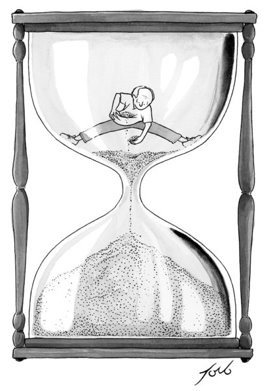

At Transcendent we understand that companies are agents of change and that, those that manage to position themselves in the area between the business value and the value to societyare the ones that will achieve a competitive advantage.

Being an agent of change means playing a key role in the transformation of society, promoting sustainable economic, social and environmental growth. To this end, it is essential to to know the impacts that the company generates on society, to manage and measure them in order to maximise the positive ones and minimise the negative ones.

In order to understand, manage and measure impacts we need information. Information, metrics and data are the basis for all business decisions. It is unthinkable for a company to undertake an investment without first carrying out a financial analysis, or to launch a new product on the market without understanding the needs of consumers.

Most companies are intuitively aware of the impacts they have on the environment and society. However, there are still very few that are committed to quantifying them. However, before we begin to explore impact measurement, we need to understand what business impact is and how we understand it.

What is business impact?

Impact is seen from a value chain perspectiveIn this context, companies have a series of inputs that they transform, through activities, into outputs. These outputs are the "tangible" results of the business activity. For example, for an infrastructure company that builds roads, an example of an input would be the raw material used to build the road and the output would be the road.

These outputs generate "Outcomes" and, in the longer term, "Impacts". Outcomes are the specific changes that a company's products or services generate in the behaviour of its customers or users, and impacts are the attribution of fundamental changes, intended or unintended, that occur in organisations or communities over the long term.

Continuing with the example of the road construction company, the "outcome" would be to facilitate access to university for young people from a small town, who thanks to the road ("output"), can more easily reach university. The "impact" is positive, and could be a percentage increase in the rate of students with higher education in the area where the road operates.

Why measure business impact?

More and more stakeholders are demanding that companies have positive financial returns while at the same time generating a positive impact on society:

- The investors increasingly favour companies committed to sustainability (ESG investment, socially responsible investment, etc.).

- The regulatorsincluding the Spanish Administration and the European Union, require companies to publish non-financial information statements.

- The customers and the company prefer to consume from purpose-driven companies that are aligned with their beliefs and values.

- The employees prefer to work in socially responsible and environmentally friendly companies.

In this context, knowing and measuring business impact is an opportunity for companies to position themselves, differentiate themselves and value the positive effect generated in society in the eyes of investors, regulators, users, shareholders and other stakeholders.

Measuring business impact

Impacts are difficult to quantify and measure, so there is no global consensus on how to measure, evaluate and report them.

There is a wide range of methodologies for measuring and managing impact depending on where the focus is sought. Among others, GIIN, BLab, GRI, GSG, the OECD or the WBA. Several are part of Impact Management Project (IMP), we are a partner organisation, and they are also on the recently created Impact Management Platform.

At Transcendent we have developed a IMP-based impact measurement methodology which allows the quantification of impacts, both positive and negative, and their subsequent follow-up and monitoring.

Our experience measuring the impact of large companies is always very positive as managers acquire relevant information to make decisions with it. A trend that is growing all the time.

It seems, therefore, that impact measurement is the way forward. Because quantifying impacts enables companies to understand, manage and make decisions in line with the purpose of the business, so that they can be agent of positive change in society. Find out more about impact measurement at our blog!